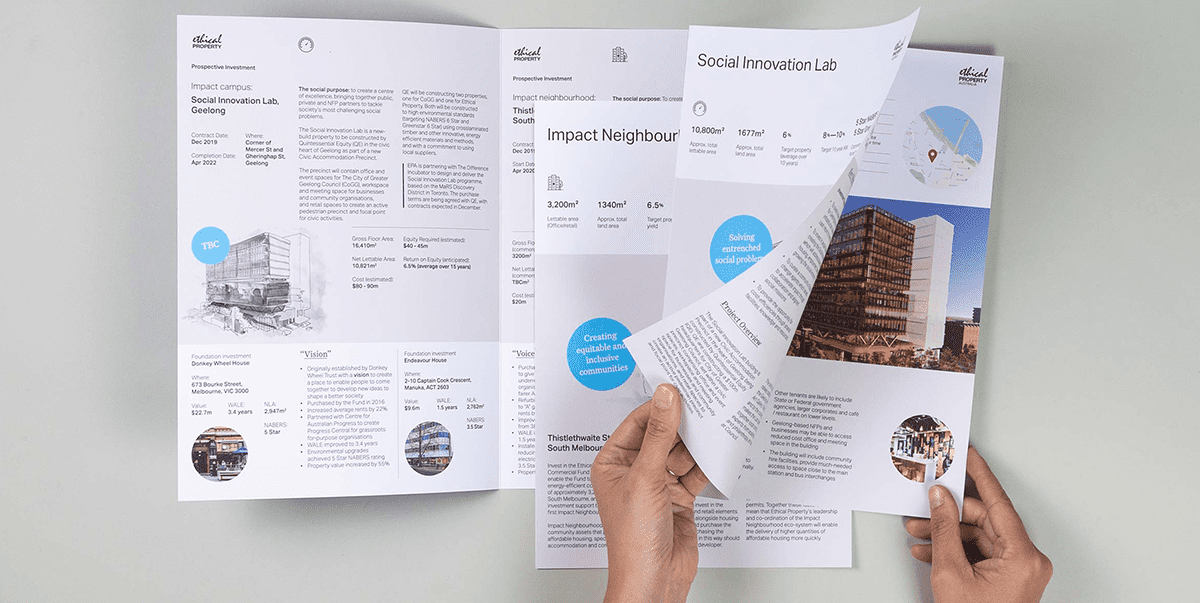

As a new entrant to the Australian super system, I can attest that its complexity is bewildering and is a major barrier to engagement. For many consumers, the temptation is to allow their employer to make decisions on their behalf: “what’s the default super? Give me that.” That implicit trust has been badly shaken by the fallout of the global financial crisis (GFC) – on a personal scale; friends’ parents have had to postpone their retirement plans as a result. And, actually, there’s nothing more personal than how we decide to invest our money. That’s why ING’s tagline – it’s your money – is so enticing, a shame, then, that it seems to have been lost in the brand transition.

It’s not just the GFC that is making waves in the super industry, the government’s Super System Review and Australia’s shifting demographics are both radically changing the environment in which the super funds are operating. With great change comes great opportunity. The certainties of the last 20 years no longer apply and, with a period of consolidation predicted, only funds with exceptional brand equity will survive. After all, how many people want to be stuck with Matter-Eater Lad as their superhero, struggling with the problem of how to make himself useful, when there’s Superman and Batman busy saving the world.