Recent IBIS World industry reporting terms aged care as a ‘sector ripe for consolidation’. 92% of the sector consists of single facility (63%) or 2-6 facility (29%) operations facing increasing margin pressure and government funding reductions. Economies of scale are being pursued through aggressive greenfields and brownfields developments. Major public listed, private and not-for-profit companies are mopping up smaller providers or entering ‘mega-mergers’ such as that between Mercy Health and Southern Cross Care in Victoria.

Mergers or acquisitions (M&As) are an important part of the growth strategy for most major companies. They reduce competition, boost economies of scale, grant immediate market access, and often bring new intellectual property or service/product lines. The outcomes are reduction in costs, market leadership, revenue growth, vertical/lateral integration and, sometimes, a reinvention of the business.

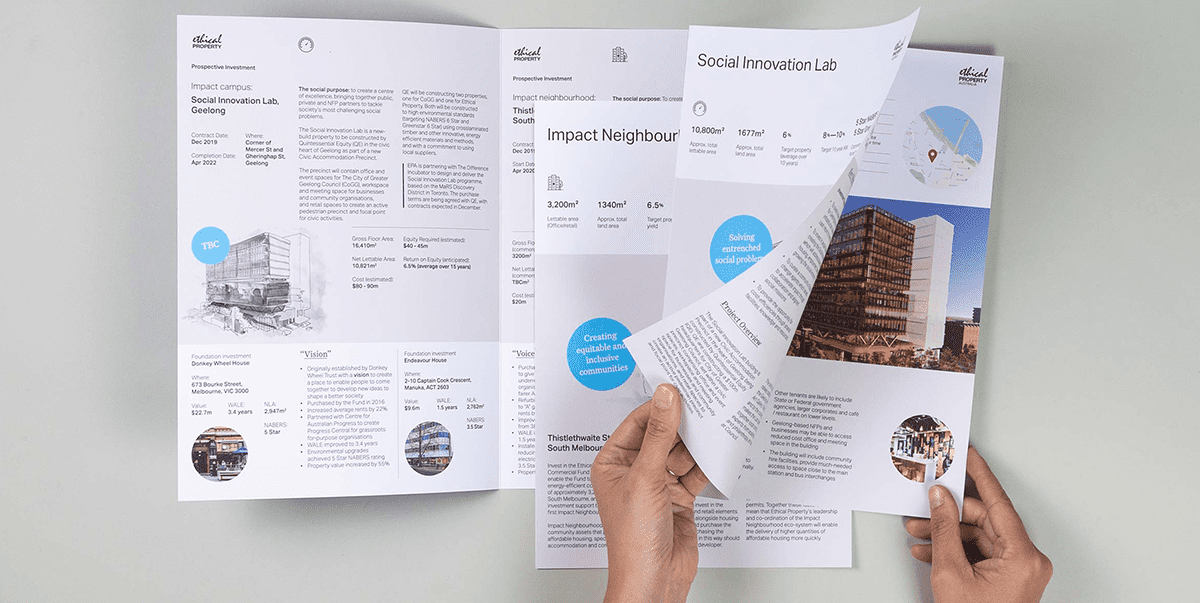

Aged care mergers and acquisitions communications.

M&As are also complicated and often protracted activities that require teams of advisors to assist in navigating intertwined and sometimes conflicting legal, financial and communication processes. Throughout that process, risks exist for both parties and their stakeholders.

Studies put the failure of M&As at somewhere between 70-90% (Harvard Business Review). That’s an astounding figure given the level of activity usually underway in any given sector. So why do they fail?

An AT Kearney global survey identified merger failure rates at different stages:

- Strategy development, target shortlisting, due diligence – 30%

- Negotiation and closing the deal – 17%

- Post-merger integration – 53%

At every stage, strategic and tactical communication plays a role. However, it is most important in the post-merger stage. And that’s when 53% fail.

“Communication is viewed as a backbone of M&A success and one of the prime reasons for M&A failure” – Aguilera, R., & Dencker, J. (2004)

Ellis Jones consultants have worked through many mergers and acquisitions as well as IPOs. Although the market context, industry and companies vary, the drivers for human behaviour don’t. Recognising and preparing for the non-financial and legal aspects is critical to success, and will support these other processes rather than undermine them.

The most valuable assets of an aged care provider are its workforce and the relationships they hold with families, referrers and stakeholders. Keeping staff (at least most of them) is critical to not only the success of the business but the health of residents/clients and compliance with accreditation standards. A lot is at risk.

People are rational and emotional. Emotion commonly dominates reason at times of uncertainty or pressure – or elation when a deal is done. The previous owner or board members of a provider see the company’s legacy as their own. Families and communities have strong connection to the company based on historic success, the narrative of tradition and a legacy of experience. Employees are very wary (and often weary) of change. Even if the past wasn’t perfect, an uncertain future creates fear and distrust.

In all cases, identity, a sense of ownership and a perceived entitlement to influence are at play.

In this emotional context, communication by the company can have an amplified effect – positive and negative. People can buy into a vision but, if it is too distant from their reality, it will be viewed as extreme. People leave, and risks materialise as serious operational issues.

Complicating all of this are the mainstream and niche media and the perceptions and fears they create. Once infrequently seen on the social pages, aged care is now commonly featured across the nation’s most prominent mastheads: from the front page, through the health and now finance sections. The emergence of aged care as a ‘boom’ industry and the listing of private companies on the stock exchange have intensified scrutiny from the media with coverage generally featuring powerful voices in government and politics. It’s here to stay.

Some key elements of aged care mergers and acquisitions communications.

So, what should you be communicating to whom and when?

Insights

Locked in the data room, deep in clandestine negotiation, it is easy to forget about the activity on the ground inside the company you are purchasing. How much do you know about the staff, the strategic relationships locally held and their attitude to the current leadership? Without that insight, you are flying blind – every announcement you make is based on assumption. Get into the facilities, mine the company’s satisfaction research and/or demand an independent research project be initiated. Go beyond the facility to understand what matters to the community it serves and relies upon.

Messaging

The differences between motivations become acute while a deal is being struck. The owner and investor see dollar signs and litigation, employees (as soon as there is a sign of M&A activity) see trouble, and clients, families, and residents see interruption and risk. Each can easily express a sentiment that is an anathema to the others.

Messaging should therefore focus on shared outcomes – ‘a bigger company with more opportunities’ – than any one stakeholder – ‘shareholders will enjoy an increase in dividends from a reduction in staffing’. Develop a coherent, concise central narrative about the immediate benefits and confidence in the future that a merger represents. Changing the logo is not the focus. Motivating and incentivising performance is.

The syntax and words used should be those which each stakeholder uses. Well-crafted corporate messaging appropriate to an annual report or board paper will emphasise the distance between people and the decisions being made about their future. Similarly, being too colloquial will breed mistrust and suspicion of hidden intent.

Timing

An important rule is to always tell employees first. Directly, and via their managers. In health and care settings, staff have intimate relationships with clients/residents and, often, the company is not visible or considered (many aged care facilities continue to be known as ‘Jane Smith Nursing Home’ to local people even though they pass the corporate signage every day). Therefore, staff need to be able to communicate the changes simply and with some confidence to the consumer.

Plan and make successive announcements at regular points over time so people feel the positive momentum. Be present in the lives of residents and employees from day one. Apply change management theory and make the vision more visible over time. Ensure staff feel the benefits early on.

Key people

Broadly, the list of groups who need regular and considered communication are the extended board (outside those part of the negotiation), key investors, the executive, line management, employees, customers, regulators, referrers, and suppliers. Within each group there will be detractors, sceptics, advocates and those who, without engagement, will remain silent (at least publicly).

The task is to engage sceptics and detractors to understand their perspective and predict their behaviour, engage the silent majority so that rumours do not bloom (like mushrooms in the dark), and organise/motivate the advocates with information and incentives.

Line management are always very important. In aged care, these roles are facility managers and case managers as well as team leaders in facilities and corporate office. They are most likely to skew the message so, while communicating through them, you must communicate around them via established channels such as newsletters and email but also postering and site visits from the advocate team.

“84% believe an organisation that has a shared purpose will be more successful in transformation efforts.” – EY Beacon Institute with Harvard Business Review

We hear a lot about purpose and ‘start with why’ in corporate Australia these days but, unlike many industries, health and aged care businesses create social value every day: for families and employees, many of whom live, shop and socialise together in local neighbourhoods. It’s really not difficult to define the social purpose and put some numbers against it – and this is what unites all stakeholders during a merger or acquisition.

In summary, not long into the negotiation process, successful M&As are predominantly about effective communication. From the behaviour of current and in-bound leadership to line management, employees, referrers and families.

Customer and employee insights are required for effective stakeholder and scenario mapping, messaging and the activation of the vision over time. It takes time to merge systems and practices, so be realistic about timelines: the excitement you feel in your chest may not be shared by employees for many months to come.

Keep listening: get close to the staff and customers; turn insights into service innovation and employee engagement/better conditions. And, have a high-level plan that focuses on shared purpose/value: communicate it early and consistently.

Talk to us about aged care mergers and acquisitions communications.

This article summarises a presentation made as part of a panel discussion sharing merger and acquisition expertise – communication, legal and financial – at the LASA National Congress, Gold Coast, on 16 October.