Redefining a brand that delivers spaces for impact.

Learn more about this project

Challenge

Ethical Property Australia owns, leases and manages property assets that positively impact people living and working in and around them. Famously the seat of Melbourne’s co-working revolution with Donkey Wheel House, Ethical Property has grown its assets under management. It has a future vision for impact neighbourhoods and was raising impact capital to achieve it.

Response

Applying our knowledge of the impact investor mindset, brand and communication expertise and a passion for working with clients who want to change the world for the better, Ellis Jones worked with Ethical Property to reposition the business and prepare for investor outreach.

Our work comprised:

- Brand identity and experience workshops to map the needs of key target users/audiences against Ethical Property’s assets and services

- Naming and visual stimuli workshops to explore brand expression.

- Development of value proposition, key messaging and brand narrative.

- Development of a new visual identity comprising direction for typography, photography, illustration and colour palette.

- Definition of possible naming directions

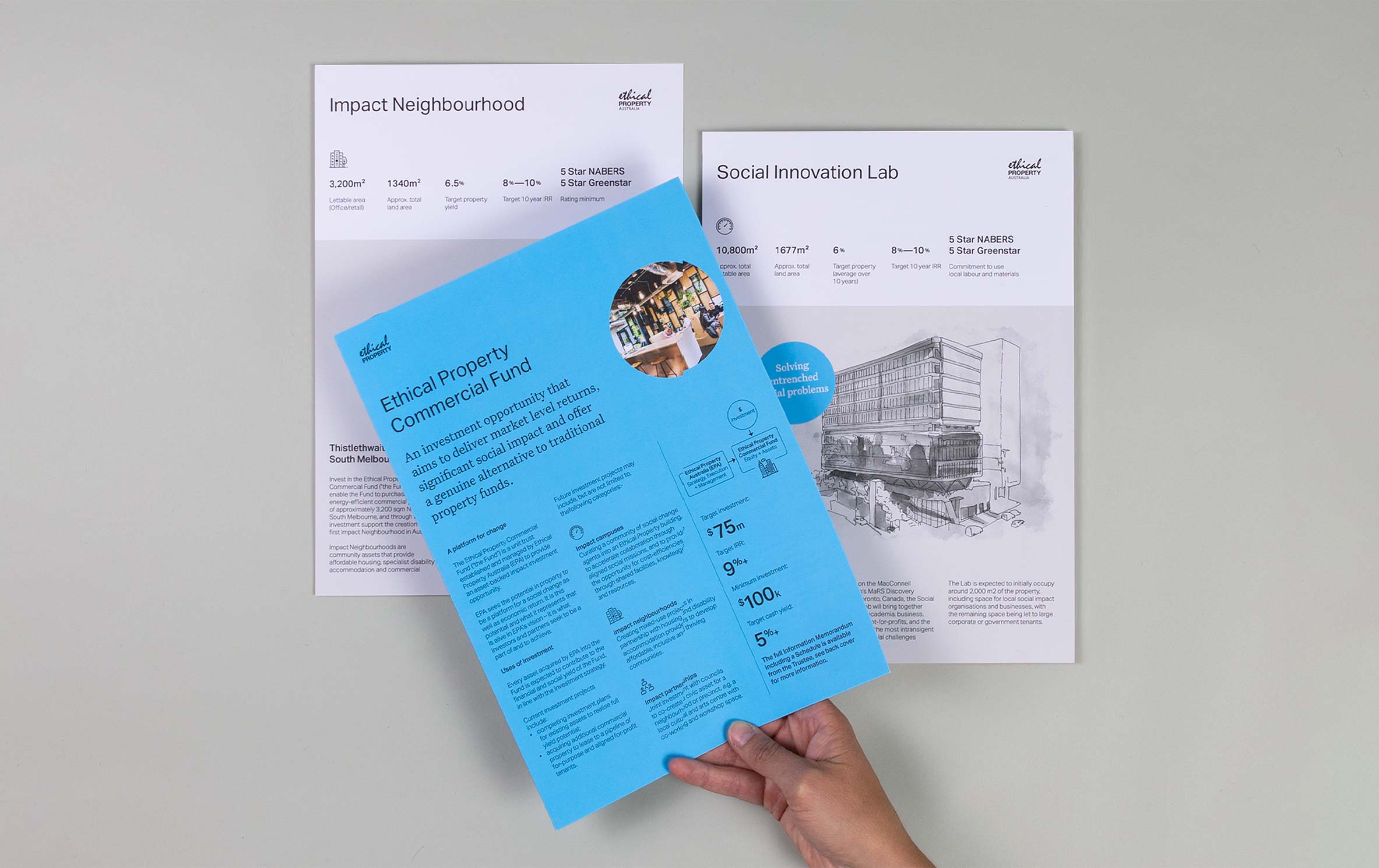

- Creation of an Investor Memorandum as the first step in introducing the new brand.

Outcomes

The Ethical Property team are highly experienced, entrepreneurial and collaborative. We enjoyed a process of rapid ideation from broad context to specific executions.

Key outcomes from our work with Ethical Property include:

- A refreshed brand identity to guide strategic decision- making and ensure differentiation from any other business that may be perceived to be similar.

- A brand narrative and value proposition that helps navigate the complexity of the new model while building excitement for its potential.

- A visual identity which includes a visual branding system (‘brand book’) and core assets.

- An Investor Memorandum (IM) that is unique in design and precise in its offer.

The brand and visual identity approaches were all approved by the Ethical Property investment board. The IM has been received well by potential investors in the first round of roadshow activities.